Fed Takes Cautious Approach: Quarter-Point Interest Rate Rise Implies Possible Pause

Fed Takes Cautious Approach: Quarter-Point Interest Rate Rise Implies Possible Pause

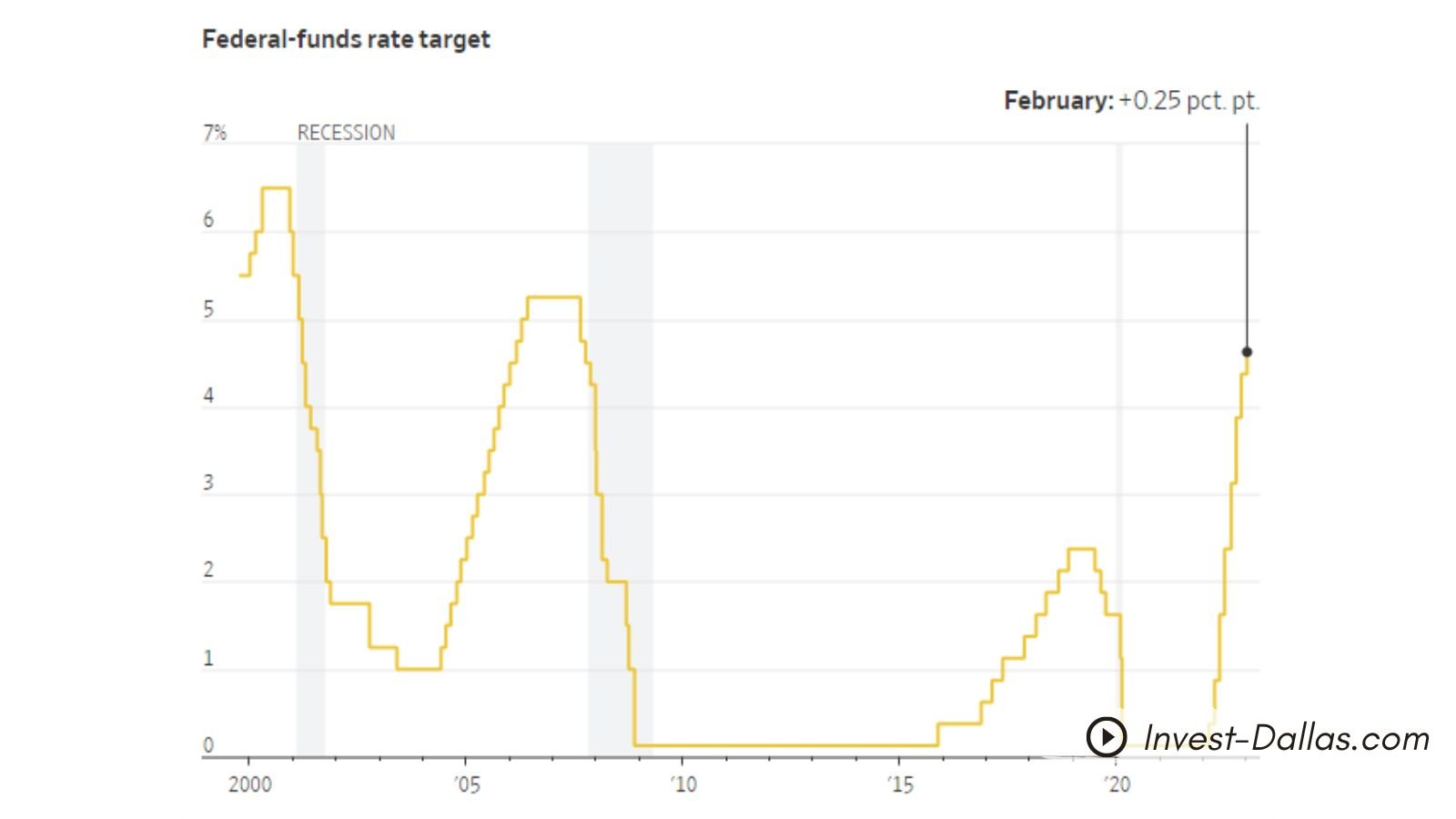

The Federal Reserve’s careful approach to managing short-term interest rates came to the fore as they decided to nudge up rates by a quarter-percentage point. Moreover, they hinted at the possibility of doing so again at the next meeting, signaling a cautious stance towards further increases during late spring. This move follows a series of six more substantial rate hikes undertaken by the central bank to combat the surge in inflation, which reached its highest point in the last 40 years. Notably, officials raised rates by a half point in December and by 0.75 point in November.

Officials Pause Rate Rises for In-Depth Study

The decision to slow down rate hikes was driven by a desire to gain more time to thoroughly analyze the effects of their previous actions. “We’re talking about a couple more rate hikes to reach a level we consider appropriately restrictive,” revealed Fed Chair Jerome Powell during a news conference after the policy meeting. Despite indications that wage and price growth might have peaked several months ago, Powell emphasized the need for caution and refrained from declaring a definitive victory.

Positive Market Response

Investors welcomed the Fed‘s decision, leading to a rally in the stock market. The S&P 500 closed up about 1% at 4119.21, while the Nasdaq Composite surged by 2% to 11816.32. The Dow Jones Industrial Average also experienced a slight increase, rising by 6.92 points to 34092.96. In contrast, the benchmark 10-year U.S. Treasury note’s yield declined to 3.398% from 3.527% the previous day. This decline in yields is a result of rising prices, as yields tend to fall when prices increase.

Read More:

- When is iPhone 15 Released? | Announced Model, Color, Release Date

- Facebook Acknowledges Detrimental Impact of Instagram on Teen Girls

A Year of Rate Increases

The recent increase marks the culmination of a year during which the Fed raised the fed-funds rate from near zero to a range between 4.5% and 4.75%, a level last seen in 2007. This period represents the central bank’s most rapid interval of rate increases since the early 1980s. While Mr. Powell and other officials avoided fueling speculation about a rate pause, government-bond investors sensed an imminent pause due to their expectation that last year’s rate hikes would significantly slow down the economy in the current year.

Economic Mixed Signals

Since the December meeting, economic activity has displayed a mix of indicators. On the positive side, hiring has remained steady, driving the unemployment rate down to 3.5% in December, the lowest it has been in half a century. However, consumer spending has moderated, and manufacturing activity has declined, indicating broader economic weakness beyond the housing sector’s impact. In response to this, markets have largely ignored the Fed meeting, focusing instead on these economic data points.

The Fed’s Motive: Cooling Inflation

The fed-funds rate plays a crucial role in influencing borrowing costs across the economy, affecting mortgages, credit cards, auto loans, and other financial instruments. The Fed has been raising rates to counter inflation by slowing economic growth. Their belief is that these policy moves work through financial markets by tightening financial conditions, either by raising borrowing costs or reducing asset prices, such as stocks.

Forecasting the Rate Path

Looking ahead, most Fed officials projected raising the fed-funds rate to a range between 5% and 5.25% this year, with no cuts anticipated. After the recent hike, this projection suggests additional quarter-point increases in March and May, followed by a potential pause in rate hikes. Powell emphasized that their decisions and any revisions to projections would be based on fresh reports on hiring, inflation, and growth before their next meeting in March.

Balancing Inflation Concerns

Mr. Powell, along with other economists, remains concerned that the recent decline in inflation might merely reflect the long-expected easing of supply-chain bottlenecks. There is apprehension that this might not be enough to bring inflation down to the Fed’s targeted 2% level. The Fed chair believes that a tight labor market will continue to exert upward pressure on wages and prices, despite recent signs of moderation.

Inflation Data Analysis

Overall inflation has slowed primarily due to falling energy and goods prices. Although significant increases in housing costs have abated, their impact has yet to be reflected in official price gauges. Consequently, Mr. Powell and other officials have shifted their focus to a narrower subset of labor-intensive services by excluding prices for food, energy, shelter, and goods. This metric showed a slowdown in inflation to an annualized 2.9% rate in the October-to-December period, but nonhousing services saw a rise of 4% in December over the past year and at a three-month annualized rate.

Avoiding Mistakes: Balancing Inflation and Economic Growth

The Fed faces a delicate balancing act, as it strives to prevent inflation from picking up again or settling at an uncomfortably high level. Maintaining a higher level of rates for an extended period may serve as a preventive measure. Powell and other officials are wary of repeating the mistake of waiting too long to withdraw stimulus, which occurred in the second half of 2021. By acting cautiously, they aim to avoid a scenario where inflation becomes deeply entrenched, leading to a more severe recession later on.

READ MORE:

Conclusion

As the Federal Reserve nudges up short-term interest rates by a quarter-percentage point, it signals its commitment to tackling inflation while also expressing caution. The decision to slow down rate hikes allows officials more time to study the economic effects, ensuring their policies remain data-dependent. The Fed’s focus on maintaining inflation at a sustainable level while supporting economic growth reflects the delicate balancing act it must perform to achieve its goals effectively. With uncertainty lingering, the central bank remains ready to adapt its strategies as fresh economic reports become available, emphasizing its commitment to economic stability and financial well-being.

Source: https://www.wsj.com/articles/fed-approves-quarter-point-rate-hike-signals-more-increases-likely-11675278190