Federal Reserve Takes Gradual Approach

Federal Reserve Takes Gradual Approach: Quarter-Point Interest Rate Rise Signals Slowing Tightening

The Federal Reserve recently made the decision to nudge up short-term interest rates by a quarter-percentage point, indicating that further rate increases are likely at the next month’s meeting. This move comes after six consecutive larger increases to combat the soaring inflation, which reached a 40-year high last year. In December, rates were raised by half a point, followed by a 0.75 point increase in November. Let’s find out now with Invest-Dallas.com!

Studying the Effects and Exercising Caution

Federal Reserve officials have now agreed to slow down the rate rises to allow for more time to analyze the impacts of their actions. Fed Chair Jerome Powell emphasized that they plan to implement a couple more rate hikes to reach an appropriately restrictive level. Despite signs indicating that wage and price growth may have peaked a few months ago, Powell remained cautious about declaring victory and emphasized the importance of prudently managing the ongoing situation.

Positive Investor Response

Investors positively received the decision, with the S&P 500 closing up approximately 1% at 4119.21, while the Nasdaq Composite saw a 2% increase, reaching 11816.32. The Dow Jones Industrial Average also rose, gaining 6.92 points to 34092.96. The yield on the benchmark 10-year U.S. Treasury note declined from 3.527% to 3.398% the previous day, with yields falling as prices rose.

A Year of Rate Increases

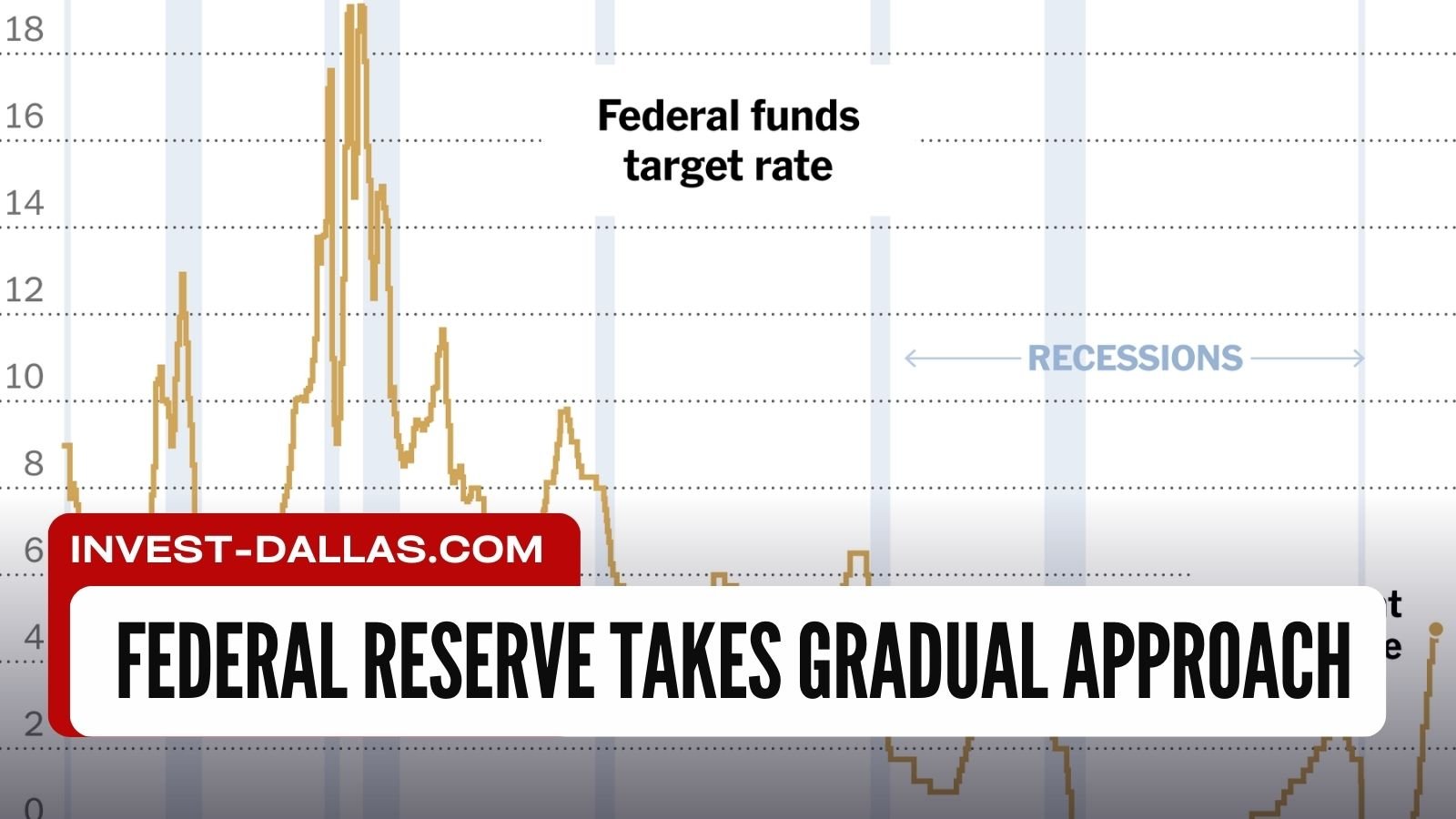

The recent increase marks a significant year for the Federal Reserve as they raised the fed-funds rate from near zero to a range between 4.5% and 4.75%. This level was last seen in 2007, making it the most rapid interval of rate increases since the early 1980s.

Speculation and Uncertainty

The Fed tried not to fuel speculation about a rate pause, maintaining the unchanged guidance from their post-meeting policy statement since last March, indicating “ongoing increases” in interest rates “will be appropriate.” However, some government-bond investors perceived the potential for a rate pause due to the cumulative effect of last year’s rate increases, which could lead to a sharp economic slowdown.

Economic Activity and Mixed Signals

Since the December meeting, economic activity has been mixed. While hiring remained steady, pushing the unemployment rate to a historic low of 3.5%, consumer spending has shown signs of moderation, and manufacturing activity has declined, suggesting weakness beyond the housing sector.

The Fed’s Strategy and Its Impact

The fed-funds rate plays a crucial role in influencing borrowing costs across the economy, including mortgages, credit cards, and auto loans. The Fed’s objective is to cool inflation by slowing down economic growth, believing that these policy measures work through financial markets, tightening financial conditions by raising borrowing costs or reducing asset prices.

Markets rallied recently as investors anticipated a slowdown in the Fed’s rate increases, reducing interest-rate volatility and easing financial conditions. Investors also speculate that a sharp economic slowdown might prompt the Fed to cut rates later in the year.

Projections for Rate Increases

In December, most Fed officials projected raising the fed-funds rate to a range between 5% and 5.25% for this year, with no projected cuts. Based on this, additional quarter-point increases are expected at the Fed’s meetings in March and May, followed by a potential pause in rate rises.

Fed Chair Jerome Powell emphasized that decisions and potential revisions to the rate projections will be based on fresh reports of hiring, inflation, and growth before the next meeting scheduled for March 21-22. He acknowledged that certainty is not appropriate in the current situation, stressing the need for patience and careful evaluation.

Mr. Powell and other economists express concerns that the recent decline in inflation could be attributed to the expected easing of supply-chain bottlenecks, and it might not be sufficient to bring inflation down to the Fed’s 2% target.

Slowing Inflation and Shifting Focus

Overall inflation has been slowing primarily due to falling energy and other goods prices. Although the large increases in housing costs have slowed down, they have not yet affected official price gauges. As a result, Mr. Powell and several colleagues have started focusing on a narrower subset of labor-intensive services, excluding food, energy, shelter, and goods prices.

The Fed is likely to continue signaling that rates will remain at a higher level for an extended period to prevent inflation from resurging to uncomfortable levels. Officials have been cautious about the possibility of waiting too long to withdraw stimulus, and they aim to avoid the risk of needing a deeper recession to control inflation.

Managing Risk and Inflation

Mr. Powell maintains that the risk of not raising rates enough and allowing inflation to surge is more dangerous than raising rates too high and causing a recession. He believes that the latter scenario allows for a more immediate reaction by cutting rates if necessary. The Fed is aware of the challenges posed by inflation and aims to strike the right balance to achieve their goals effectively.

In conclusion, the Federal Reserve’s recent decision to slow its tightening by a quarter-point interest rate rise reflects the cautious approach taken to manage inflation while closely monitoring economic indicators. The ongoing uncertainty surrounding the rate outlook and inflation dynamics calls for data-driven decision-making, allowing the Fed to navigate through potential challenges and ensure a stable and resilient economy.